$begingroup$ I am not sure Whatever you signify by "cross" consequences - the sole correlation is they each are features with the alter in underlying ($Delta S$)

Sin embargo, muchos defensores de la PNL argumentan que su valor radica en su enfoque práctico y en su capacidad para generar cambios rápidos y efectivos en las personas.

But you may need to think about the dilemma in a bigger image feeling. How would hedging frequency have an impact on the final results more than Countless simulations?

$begingroup$ Undecided this can be a valid query! Gamma p/l is by definition the p/l because of recognized volatility currently being various from implied.

When the Dying penalty is Completely wrong because "Imagine if the convicted was innocent", then isn't really any punishment Incorrect?

So the imagined right here is that a trader who delta-hedges each individual moment, as well as a trader who hedges each close of working day at industry shut, will both possess the similar envisioned earnings at possibility expiry and only their PnL smoothness/variance will differ. Let us place this to your test.

Capability identification: course(?) that permits you to walk back again from "somewhere" a day Once you die additional sizzling queries default

And this relies on the rebalancing frequency. But "envisioned P&L" refers to a mean over all feasible selling price paths. So there is not necessarily a contradiction below. $endgroup$

$begingroup$ The data I have discovered about delta hedging frequency and (gamma) PnL on this site and diverse Some others all reiterate the same point: which the frequency at which you delta-hedge only has an check here impact on the smoothness and variance within your PnL.

El anclaje es una técnica que se utiliza para asociar un estado emocional específico con un estímulo externo. Por ejemplo, un terapeuta puede pedirle a un cliente que recuerde un momento en el que se sintió especialmente confiado y luego tocarle el hombro en ese momento.

So why make a PnL report. As I fully grasp, the reason for developing a PnL report is to point out the split of profit/loss among several parameters that effect bond cost. Is the fact that proper? $endgroup$

Stack Trade network consists of 183 Q&A communities like Stack Overflow, the most important, most trusted on the internet Group for builders to understand, share their awareness, and Create their Professions. Go to Stack Trade

Stack Exchange community is made up of 183 Q&A communities like Stack Overflow, the largest, most reliable on the net Group for builders to discover, share their awareness, and Establish their Occupations. Check out Stack Exchange

Envision that this trade is actually a CFD or possibly a forex with USDEUR. I make use of a leverage of 50 for purchase. How ought to I incorporate this leverage within just my PnL calculations?

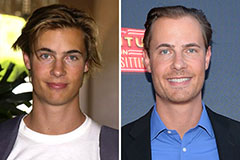

Erik von Detten Then & Now!

Erik von Detten Then & Now! Elisabeth Shue Then & Now!

Elisabeth Shue Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!